Receiving child benefit while studying: Important facts

Table of contents

Table of contents

Child benefit is an important source of money for many students. In this article you will learn the ten most important facts about child benefit and what you should look out for.

How much child benefit will there be in 2023?

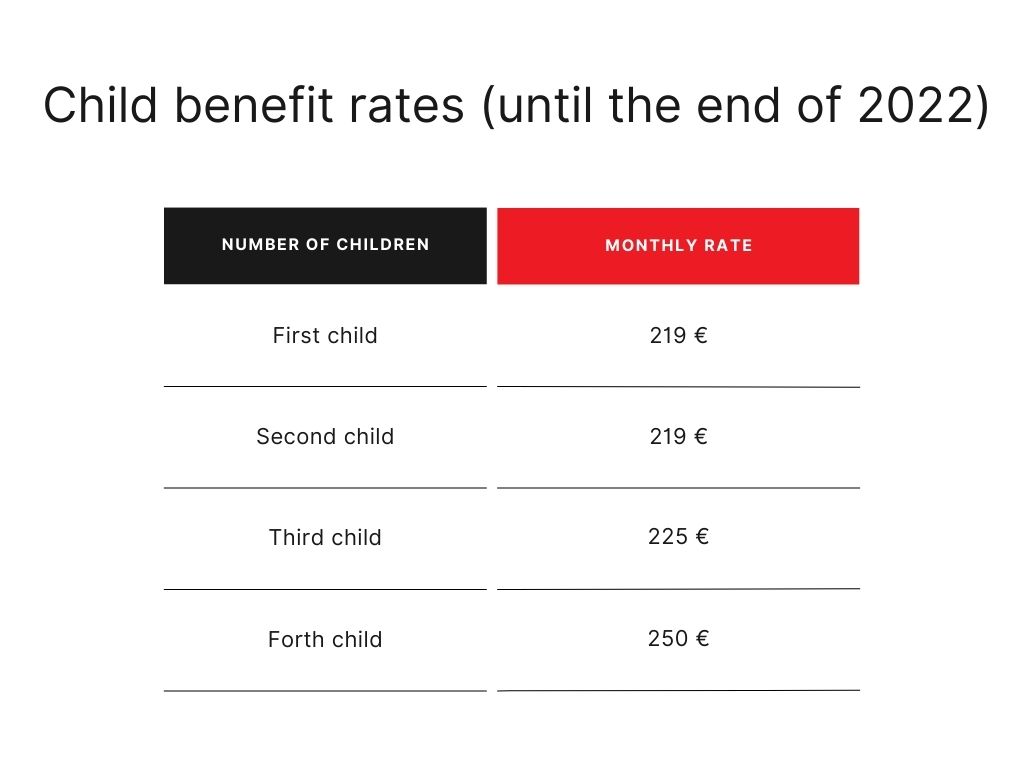

Until the end of 2022, child benefit was increased in stages per child. It started at 219 euros for one child:

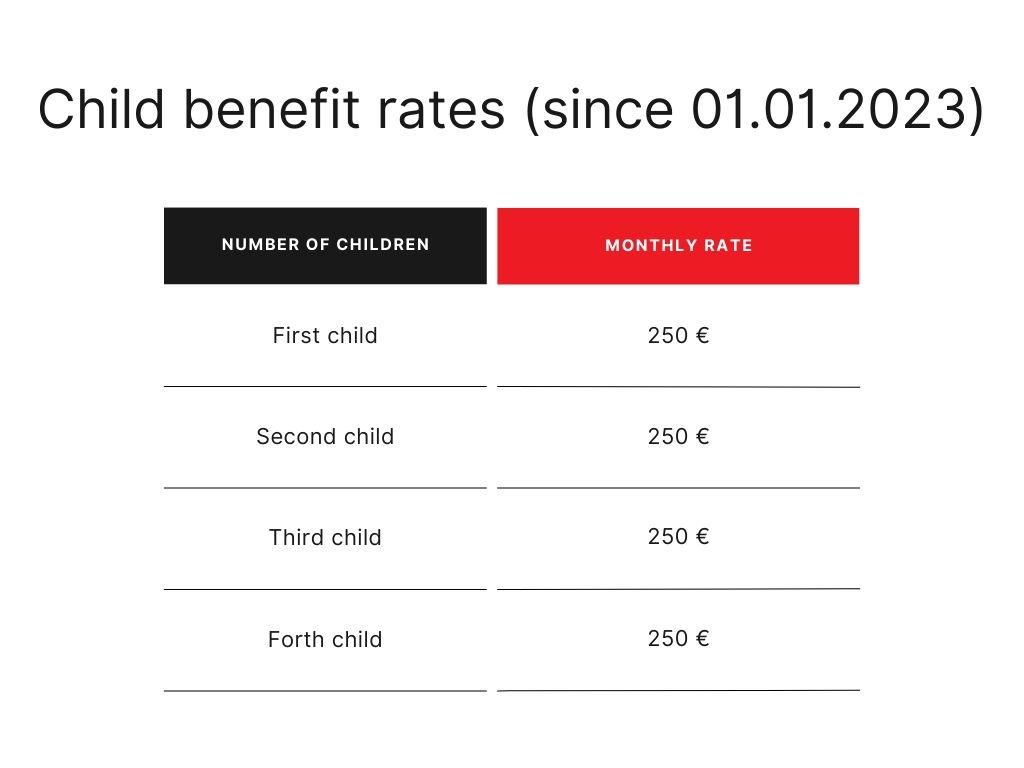

As of 01.01.2023, parents receive the same amount of child benefit, regardless of how many children they have. Your parents will therefore receive 250 euros per month for each child:

This means that it no longer matters whether or how many siblings you have. Since the beginning of the year, there is a rate of 250 euros for each child.

Until when do I get child benefit?

Actually, child benefit is only paid until the child’s 18th birthday. However, under certain circumstances, child benefit can be paid until the 25th birthday. One of these circumstances is that you are in initial education, which includes initial studies.

Thus, you are entitled to child benefit until your 25th birthday if you are studying for the first time. However, your parents need proof that you are actually studying, e.g. regular enrollment certificates from the respective semester. Your parents can upload this proof online via the Familienkasse.

Tip: Child benefit can also be granted if you are in a secondary education or a secondary course of study. In this case, the state primarily looks at how much work is done on the side. If this is more than 20 hours per week, there could be difficulties with the approval of child benefits.

You can find more exceptions and conditions for side jobs in connection with child benefit in the following section “Child benefit and side jobs”.

Child benefit and part-time jobs: You must pay attention to this

If you work in a marginal job to earn money in addition to your studies, this does not affect your child benefit. This includes, for example, mini-jobs where you earn a maximum of 450 euros per month. Short-term jobs such as one-time promo jobs are also generally unproblematic.

As a rule of thumb, you can remember that the average weekly working time of a part-time job should not exceed 20 hours.

Article tip:Earning money as a student: 10 creative ways

There is also income that basically does not affect the child benefit:

- Dual or part-time studies

- Legal clerkship (as preparation for the 2nd state examination in law and for teacher training)

- Internships or traineeships accompanying studies

The year of recognition for educators, a training relationship according to the Vocational Training Act and a service relationship with civil servant candidates or professional soldiers are also considered exceptions that do not affect child benefits.

Child benefit & BAföG: Can they go together?

Child benefit and BAföG have nothing to do with each other. Child benefit is earmarked for a specific purpose; you do not even have to state that you receive child benefit on your BAföG application.

For the approval and the rate of BAföG, a completely different factor is decisive: the income of your parents. If your parents’ income exceeds a certain amount, they have to pay for your living expenses, otherwise you are entitled to BAföG – with or without child benefit, it doesn’t matter.

Child benefit while studying abroad

You are still entitled to child benefit if your stay abroad is a short one. This refers to stays abroad with a maximum duration of 12 months. In this case, the state assumes that you will remain resident in Germany.

If you study abroad for a longer period of time, you only have a chance to receive child benefits, provided that you reside with your parents. However, you would have to prove that you actually use the apartment or the house of your parents for living. It is not sufficient to state your address as your residence; you must be able to prove that you spend more than 50% of your study-free time with your parents.

Are my parents allowed to keep the child benefit?

Your parents are obliged to support you until you have completed your first professional training, e.g. a course of study. They must therefore ensure that you receive enough money from them to cover your daily living expenses. The amount of child support is calculated according to the income of your parents, the yardstick for this is the so-called Düsseldorfer Tabelle.

The child support is counted towards the support of your parents, i.e. your parents are obliged to pay you support as so-called cash support including child support in the full amount. If this does not work, you can apply for a diversion in order to receive the child benefit directly on your account.

Tip: The rules for alimony and child support are complex, so if you have any questions, contact an advice center or a lawyer who specializes in this area.

More articles in our blog

We hope that our tips on child support in college have helped you. Here you can find more great articles about finances, choosing a course of study, health, etc.:

- 10 tips for more satisfaction in everyday life

- Earn money as a student: 10 creative ways

- These tools & services are free for students

- Tax return as a student: How to make it worthwhile!

- Exam nerves: How to get them under control

- How much does student life cost?

- 5 healthy recipes for students

- Which study program suits me? Study choice tipps